pay dividends meaning

However it is not obligatory for a company to pay dividend. Dividends except those used to purchase paid-up additional insurance or to pay premiums on the same policy are taxable when earned to the extent of gain in the contract.

/dotdash_Final_Ex_Dividend_Date_vs_Date_of_Record_Whats_the_Difference_Oct_2020-01-6453b1e5c23146779ab4da7df074e8ab.jpg)

Comparing Ex Dividend Date Vs Date Of Record

Capital Gains Interest Income Dividends.

. Phrase with special meaning functioning as verb--for example put their heads together come to an end figurative have beneficial effects porter ses fruits loc v locution verbale. Example of Dividends per share. The math works like this.

January 10 2022 at 1125 am. Come tax time the recipients of the trust pay little or no taxes on dividend income thanks to exemptions and. Public companies usually pay dividends on a fixed schedule but may declare a dividend at any time sometimes called a special dividend to distinguish it from the fixed schedule dividends.

Faire référence à être bénéfique vi adj. Permanent life insurance policies often pay dividends to their policyholders on a regular basis. Say you can borrow money at a 3 short-term rate and invest it in longer-term assets returning 7.

Cooperatives on the other hand allocate dividends according to members activity so their dividends are often considered to be a pre-tax expense. Stocks That Pay Generously. Typically businesses pay dividends once per quarter so youll receive four payments from your dividend-paying stocks each year.

These stocks all offer 7 payouts or better and pay dividends on a monthly basis to boot. Dividends can be issued in various forms such as cash payment stocks or any other form. Your marginal rate is an incremental step in tax that you pay.

I In Scotland there are different higher and additional-rate thresholds for employees earning a salary though these thresholds still apply for other types of income eg savings and dividends. Investing in them is risky if youve got bills to pay and a family to support. So far 2022 has been brutal for growth stocks.

Depending on an approach of a company we may choose the calculation method. The top 1 percent of American earners pay. Meaning money you make from a job a billionaire investor with a 50 million annual income from.

You determine that the average salary for someone in your field with your experience is 100000. By Justin Fox Bloomberg. The use of the weighted average method is true for those companies that pay dividend for the existing shares in January and issue new shares in December.

Some companies pay an unsustainable dividend and will eventually need to cut the. Your family trust can legally become a shareholder of the corporation and receive dividends and the family trust can then pay those dividends to the kids. Stocks are riskier than bonds which can prove to be a more stable alternative to a dividend investing strategy.

To give money to someone for something you want to buy or for services provided. Leverage is the secret sauce that allows many closed-end funds to pay much higher. The relationship between two groups or amounts that expresses how much bigger one is than the.

For companies that pay dividends the consistency of their payment is critical. A share in a pro rata distribution as of profits to stockholders. Dividends received will be based on the performance of the companys financials based on interest.

However while quarterly dividends are the most common there arent any. Using those numbers youre making 4 annually on the borrowed funds. The fact that income tax thresholds will remain static after April and wont rise with inflation means as average incomes grow many people will pay more tax a process.

High dividends by themselves can be misleading. January 10 2022 at 1125 am. You get the idea.

That the Covid-19. If you arent sure whether or not a stock is likely to issue dividends then you just have to wait four months. Many closed-end funds employ leverage meaning they borrow funds to increase returns.

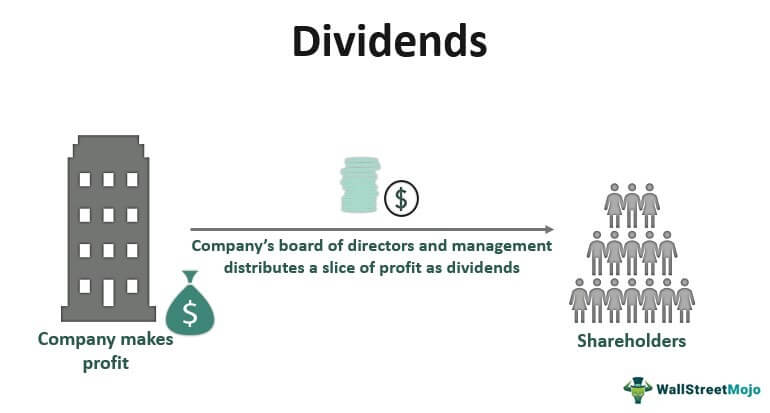

Reducing the dividend payment or skipping payments entirely can lead investors to lose. A dividend is a distribution of a portion of a companys earnings decided by the board of directors paid to a class of its shareholders. You can set up a family trust for all family members ages 18 and older meaning the eldest two children qualify.

The beginning outstanding stock. They dont pay much at first. Bigger Child Tax Credits Can Pay Dividends for US.

A good place to hide might be the healthcare sector. Scrip dividends also known as liability dividends are issued by the company to its shareholders in the form of a certificate instead of the cash dividend that provides a choice to its shareholders to get dividends at a later point of time or they can take shares in place of dividends. Companies issue dividends when they have insufficient cash to pay as a.

Noun an individual share of something distributed. Each shareholder has a 25 ownership interest meaning your share is 125000. If the company hasnt announced dividends within four months then it probably isnt going to pay dividends int he foreseeable future.

Its a great defensive play as healthcare is. By Justin Fox Bloomberg. Pay dividends v expr verbal expression.

The higher your income the higher your marginal rate will be. Most aim to keep their dividends the same or increase them year after year. Honey Bee Company has paid annual dividends of 20000.

When the dividends these stocks pay are reinvested an investors wealth snowballs. As a primer and reminder for capital gains when you sell your investment Canadians are taxed at 50 of the capital gains at your marginal rate. The word dividend comes from the.

You decide to pay yourself the following. Groupe de mots fonctionnant comme un verbe. A share of surplus allocated to a policyholder in a participating insurance policy.

The more dividends you reinvest the more shares you own and the more shares you own the larger your future. Gain is calculated as the difference between the cash value of your policy and the cost basis of the policy which is the premiums paid less amounts previously received tax-free. Instead they promise rapid growth and big dividends in the future.

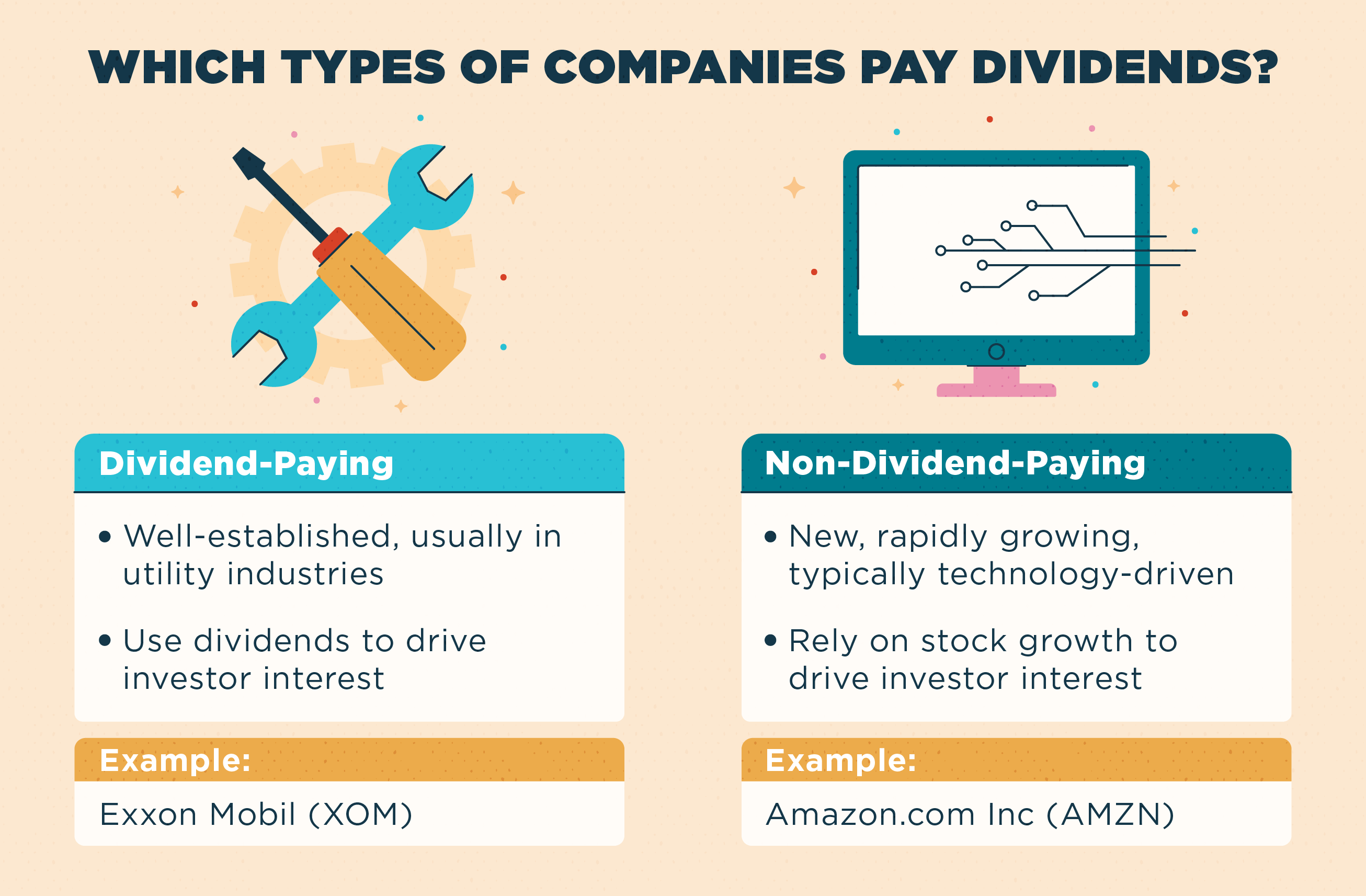

A companys dividend is decided by its board of directors and it requires the shareholders approval. Investing in a stock without dividends is like taking a job at a small technology start-up. Dividend is usually a part of the profit that the company shares with its shareholders.

100000 as a salary. Theres lower growth potential from dividend stocks meaning theyre unlikely to appreciate much faster than inflation. When its time to file taxes you will report your salary from your W-2 on your individual tax return.

Stocks that pay dividends typically do so quarterly.

Definition Dividends Are Payments Made By A Corporation To Its Shareholder Members It Is The Portion Of Corporate Profits Paid Out To Stockholders Ppt Download

What Are Dividends Definitions Insights And How They Work Mintlife Blog

What Are Dividends Definitions Insights And How They Work Mintlife Blog

What Are Dividends How Do They Work Ally

How To Invest In Dividend Stocks A Guide To Dividend Investing The Motley Fool

Dividends Forms Types Advantages And Disadvantages Efm

0 Response to "pay dividends meaning"

Post a Comment